The insurance industry has long been associated with paperwork—stacks of policy documents, claim forms, renewal notices, and compliance letters. While these processes have traditionally kept business running, they are also slow, error-prone, and costly to maintain in the contemporary digital-first world.

Modern policyholders expect the same level of convenience from their insurers that they receive from banks, retailers, and digital-native companies: instant service, transparent communication, and seamless online experiences. At the same time, insurers face mounting regulatory pressures, tighter margins, and increased competition.

This combination of customer demand and market pressure makes it clear: paper-based processes can no longer keep pace. Document automation for insurance has emerged as the enabler of this transition, empowering insurers to generate, manage, and deliver documents more quickly, accurately, and cost-effectively. Studies suggest insurance companies that implement document automation report an average reduction of 65% in total operational costs by automating customer onboarding, policy management, and claims workflows.

With Cincom CCM, insurers can modernize communications, ensure compliance, and deliver personalized policyholder experiences while finally moving beyond the limitations of paper.

Ready to modernize your insurance communications? Schedule a demo and discover how Cincom CCM can help.

The Challenges of Paper-Based Processes in Insurance

Paper-based operations may have sustained insurers for years, but today they create significant obstacles. Here are the most pressing challenges that clearly demonstrate why insurers need to move toward insurance document automation:

| Challenge | Details |

| Slow Turnaround Times | – Policy issuance, renewals, and claims documentation often require manual preparation and mailing.

– Delays frustrate policyholders and increase churn risk. |

| High Error Rates | – Manual data entry and document handling introduce mistakes.

– Lost forms, duplicate records, or inaccurate information compromise compliance and customer trust. |

| Regulatory Pressure | – Insurance documents must comply with complex and evolving regulations.

– Manual review increases the risk of non-compliance penalties and reputational damage. |

| Rising Operational Costs | – Printing, mailing, and storing paper records drive up overhead.

– Resources are wasted on repetitive admin work instead of customer-facing service. |

| Lack of Agility | – Paper makes it difficult to scale operations or adapt to new products, markets, or customer demands.

– Competitors using automation software move faster and set higher expectations. |

Don’t let paper slow you down. Talk to an expert and see how automation eliminates delays and errors.

What Is Document Automation in Insurance?

Document automation for insurance refers to the use of technology to automatically create, manage, and deliver critical documents such as policies, claim letters, disclosures, and renewals, without manual intervention. Instead of relying on paper and manual templates, insurers leverage digital tools to streamline every stage of document handling. Key aspects include:

Purpose

- Automates the creation of insurance documents using pre-approved templates and rules.

- Ensures consistency, compliance, and speed across all customer communications.

Insurance Document Management vs. Insurance Document Automation

- Document management: Focuses on storing, tracking, and retrieving records.

- Document automation: Goes further by automatically generating personalized, compliant, and accurate documents in real time.

Role of Insurance Automation Software

- Integrates with CRM, ERP, and policy administration systems.

- Pulls data directly from source systems to eliminate manual entry.

- Enables omnichannel delivery (email, SMS, portals, or print-on-demand).

Cincom CCM’s Approach

A customer communications management (CCM) platform for insurers streamlines process automation with compliance-ready templates, replacing paper-heavy workflows with fully digital, customer-focused communication.

Revamp Your Customer Communication Management with Advanced Document Generation Software

Download the whitepaper and learn how leading insurers are using document automation to improve compliance and customer trust with Cincom CCM.

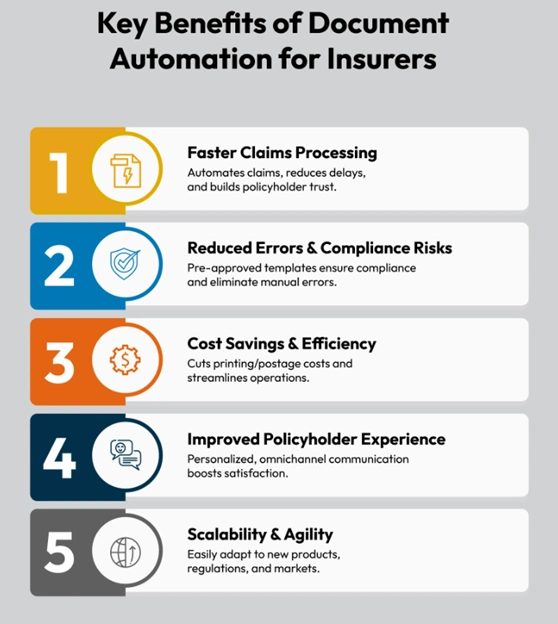

Key Benefits of Document Automation for Insurers

Adopting document automation for insurance delivers measurable improvements across efficiency, compliance, and customer experience. Here are the most impactful benefits:

1. Faster Claims Processing

- Automates claim acknowledgments, status updates, and settlement letters.

- Reduces manual handoffs that delay claims resolution.

- Builds policyholder trust with quicker, transparent communication.

2. Reduced Errors and Compliance Risks

- Uses pre-approved templates to ensure every document meets regulatory requirements.

- Maintains audit trails and version control for compliance reviews.

- Eliminates human errors from manual data entry or outdated forms.

3. Cost Savings and Operational Efficiency

- Cuts down printing, postage, and physical storage expenses.

- Allows staff to handle higher volumes without adding headcount.

- Streamlines workflows by integrating with insurance document management software and core systems.

4. Improved Policyholder Experience

- Delivers personalized documents tailored to each customer’s policy or claim.

- Provides omnichannel communication—email, SMS, online portals, or print-on-demand.

- Enhances customer satisfaction, leading to stronger retention rates.

5. Scalability and Agility

- Enables quick adaptation to new products, regulatory changes, or market demands.

- Supports real-time document generation as insurers expand into new channels and geographies.

By automating critical communications, insurers reduce risk, speed up service, and deliver better experiences.

Real-World Use Cases of Document Automation in Insurance

Insurance document automation is already transforming how insurers handle core processes. Here are some practical applications:

1. Policy Issuance & Renewals

- Automatically generates accurate policy documents, endorsements, and renewal notices.

- Personalizes content for each policyholder while ensuring compliance with regional regulations.

- Cuts down issuance time from days to minutes.

2. Claims Communication

- Sends instant claim acknowledgments and status updates to customers.

- Automates settlement letters, reducing delays during the claims cycle.

- Improves transparency, a key driver of customer satisfaction.

3. Regulatory Compliance & Disclosures

- Ensures every disclosure, terms sheet, and compliance notice is accurate and consistent.

- Maintains a central repository of pre-approved templates for audit readiness.

- Reduces compliance risk by eliminating manual edits.

4. Customer Onboarding & Correspondence

- Generates welcome kits, ID cards, and personalized policy documents.

- Provides consistent, branded communication across channels.

- It helps insurers create a strong first impression and build trust from the start.

Cincom Delivers Scalable Document Solution to Support Molina Healthcare’s Managed Care Growth

Discover the strategies behind Molina’s 20x increase in document output and how Cincom Eloquence made compliance and efficiency seamless.

How Document Automation Supports Digital Transformation

Moving from paper-based operations to digital-first models is at the heart of insurance modernization. Document automation for insurance plays a critical role in this transformation by enabling insurers to become more agile, compliant, and customer centric.

1. Foundation for Insurance Process Automation

Automates high-volume tasks like policies, claims, and renewals. This frees staff to focus on customer service and risk management instead of repetitive paperwork.

2. Enhances Insurance Document Management Software

Goes beyond storage by enabling fast document creation and distribution. Centralized templates and compliance rules ensure accuracy and consistency.

3. Supports Omnichannel Engagement

Delivers communications across email, SMS, web portals, and print. Customers get a consistent, personalized experience on every channel.

4. Drives Business Agility

Easily adapt documents to regulatory changes, scale for new products, or expand into new regions—keeping pace with market demands.

Steps to Successfully Implement Document Automation

Transitioning from paper-heavy processes to insurance document automation requires a structured approach. Here’s a practical roadmap for insurers:

1. Assess Current Workflows

- Identify paper-heavy processes such as policy issuance, claims communication, and compliance reporting.

- Map out inefficiencies and areas most impacted by delays or errors.

2. Select the Right Platform

- Look for scalability, integration capabilities (CRM, ERP, policy systems), and compliance features.

- Prioritize insurance automation software that supports omnichannel communication.

3. Standardize Templates and Content

- Build a centralized library of pre-approved, compliance-ready templates.

- Ensure branding and regulatory language remain consistent across documents.

4. Pilot and Scale

- Start small with one process (e.g., claim acknowledgments).

- Measure improvements, then expand automation across other workflows.

5. Train Teams and Drive Adoption

- Provide training to ensure staff can use the platform effectively.

- Communicate benefits to gain buy-in from all departments.

6. Monitor, Optimize, and Evolve

- Track KPIs like turnaround time, error reduction, and compliance accuracy.

- Continuously refine processes as business and regulations evolve.

With Cincom CCM, insurers can implement these steps seamlessly, ensuring faster ROI and smoother adoption.

Future Outlook: Smart Automation in Insurance Documents

As insurers advance their digital transformation, the next frontier is the integration of smart automation into document workflows. This evolution will further enhance speed, personalization, and compliance.

1. Personalization

Automation enables insurers to tailor policy documents, claim letters, and correspondence to individual customer needs. By making communication more relevant and contextual, it strengthens policyholder engagement and builds long-term trust.

2. Intelligent Document Classification

Incoming claims forms, supporting documents, and requests can be automatically categorized and routed. This reduces manual sorting, speeds up claims handling, and allows staff to focus on higher-value activities.

3. Predictive Analytics for Communication

By leveraging historical data, insurers can anticipate customer inquiries and provide proactive updates. This reduces uncertainty, minimizes friction, and improves the overall policyholder experience.

4. Smart Automation Across Channels

Customers expect instant access to information. Real-time updates delivered through portals, mobile apps, and chatbots support self-service and empower policyholders to access documents anytime, anywhere.

5. The Role of Cincom CCM

Cincom CCM provides insurers with a flexible, automation-ready platform. It helps organizations evolve from basic document automation to full-scale customer communication management, ensuring proactive, consistent, and customer-centric engagement.

Why Now Is the Time to Automate Insurance Documents

The insurance industry is at a tipping point. Paper-based processes can no longer keep pace with customer expectations, regulatory demands, or competitive pressures. By embracing document automation for insurance, carriers can eliminate inefficiencies, reduce errors, ensure compliance, and deliver personalized communications at scale.

Platforms like Cincom CCM make this transformation achievable, providing insurers with a flexible, integration-ready solution to automate documents and modernize customer communications. The result is faster claims, seamless policy issuance, and superior policyholder experience.

For insurers, the message is clear: the future is digital, and the time to act is now.

Discover how Cincom CCM helps insurers move from paper to digital with automated, compliant, and personalized customer communications.

FAQs

1- What is document automation in the insurance industry?

It’s the use of software to automatically create, manage, and deliver documents like policies, claims, and disclosures—ensuring accuracy, compliance, and speed.

2- How does document automation improve claims processing?

It automates claim acknowledgments, updates, and settlement letters, reducing delays and errors while keeping policyholders informed in real time.

3- Is document automation compliant with insurance regulations?

Yes. Automated templates and audit trails ensure every document meets regulatory requirements, reducing compliance risks.

4- What types of insurance documents can be automated?

Policies, renewals, claims letters, disclosures, onboarding kits, ID cards, reminders, and other customer communications.

5- How does document automation benefit policyholders?

It delivers faster, personalized, and consistent communication across email, SMS, portals, or print—improving customer experience.

6- Does document automation help insurers save costs?

Yes. By reducing printing, mailing, storage, and manual handling, insurance document automation significantly lowers operational expenses while improving efficiency.